India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures, is a funding juggernaut at $12 billion in 2024, yet it’s perilously underpowered by R&D investment—languishing at a mere 0.64% of GDP versus China’s 2.4% or Israel’s 6.3%. This gap stifles deeptech innovation, leaving Indian startups to import technologies rather than pioneer them, eroding global competitiveness amid a 300% AI funding spike and climate tech’s $1.5 billion haul. Enter Budget 2025’s Rs 20,000 crore R&D boost and Rs 1 lakh crore RDI scheme—lifelines to catalyze private investment, foster 150 unicorns, and propel a $1 trillion innovation economy by 2030.

As Anish Shah of Mahindra Group asserts, “Increasing R&D spend is critical to boost scale, encourage risk-taking, and elevate India’s competitiveness on the world stage.” Drawing from DPIIT, Forbes India, and Harvard analyses, this piece unpacks why R&D investment is non-negotiable for India’s startup global edge. Skimp on it, and watch China and Israel sprint ahead.

Table of Contents

India’s R&D Deficit: A Startup Competitiveness Killer

India’s innovation paradox is stark: Third in global startups and climbing to 39th in the Global Innovation Index (from 81st a decade ago), yet R&D at 0.64% GDP trails the global 2.7% average. Private sector contribution? A dismal 37%, versus 70% in the US, as firms opt for cheap imports over risky R&D, per Rau’s IAS. This aversion hampers deeptech—AI, biotech, quantum—leaving startups uncompetitive globally, where R&D drives 50-70% of growth in leaders like South Korea. In 2025, while India files 82,000 patents annually, only 15% commercialize, versus Israel’s 90%, underscoring the need for Rs 1 lakh crore RDI to “jumpstart” private R&D.

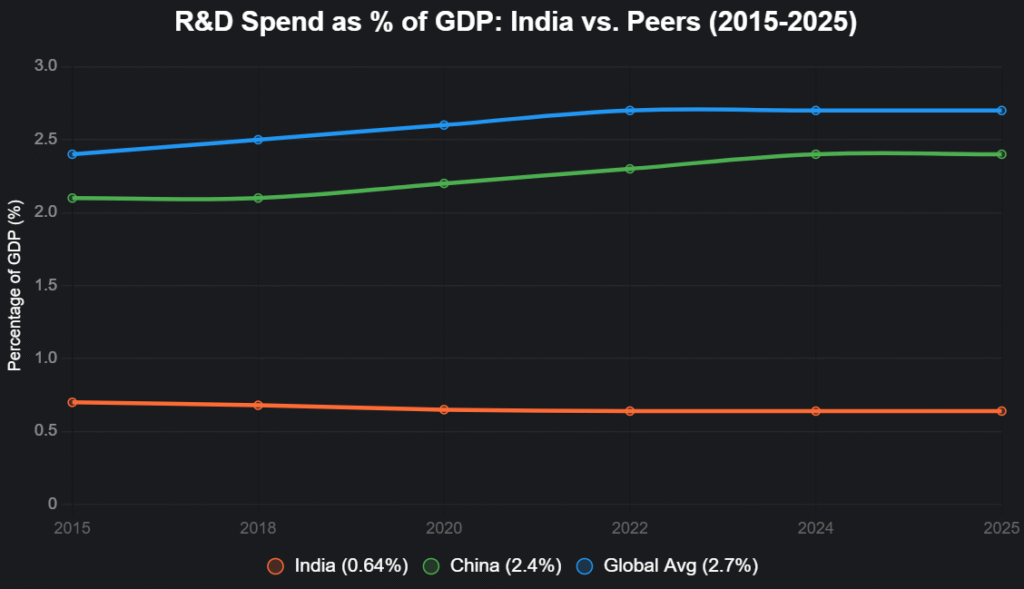

This line chart compares India’s R&D spend as % of GDP to global peers (2015-2025):

Source: World Bank, UNESCO via Rau’s IAS. Stagnation risks India’s 3rd startup rank slipping without R&D ramp-up.

Why R&D Fuels Startup Competitiveness: The Imperative

R&D isn’t a luxury—it’s the engine for differentiation, with high-investment firms 2.5x more likely to lead markets, per Harvard’s MRCBG. For India:

1. Innovation and IP Creation

Low R&D yields imported tech reliance, but boosts spawn patents: Israel’s 6.3% GDP spend drives 90% commercialization vs. India’s 15%. Rs 20,000 crore in Budget 2025 targets deeptech, birthing sovereign AI like Krutrim and biotech unicorns.

2. Attracting FDI and Global Talent

R&D signals maturity: India’s GII climb to 39th lured $10B FDI in 2024, but sustained investment could double it, per IBEF. ANRF’s Rs 50,000 crore bridges academia-industry, drawing global collaborators like Mahindra’s 346 FY25 patents.

3. Economic Multipliers and Job Creation

Each R&D rupee generates Rs 5-7 in GDP via startups, per Drishti IAS, powering 1.7 million jobs and 50 million by 2030. NDTSP fosters deeptech startups, enhancing private R&D to 50% by 2030.

4. Sectoral Competitiveness

In autos (Mahindra) and space (Agnikul), R&D filed 346 patents, boosting exports $10B. UAY promotes industry needs, elevating manufacturing edge.

R&D Impact on Startups: Key Metrics Table (2025)

| Metric | Current (Low R&D) | With 2% GDP Boost | Global Benchmark | Source |

|---|---|---|---|---|

| Startup Survival Rate | 22% | 50% | Israel 60% | Inc42 |

| Deeptech Funding ($B) | 1.6 | 5.0 | China 10B | Tracxn |

| Patents Commercialized | 15% | 50% | S. Korea 70% | UNESCO |

| FDI Inflow ($B) | 10 | 20 | US 50 | IBEF |

| Jobs Created (Million) | 1.7 | 5.0 | Global Avg 10 | CII |

Projections based on 2% GDP target; low R&D caps competitiveness.

Case Studies: R&D’s Startup Success Stories

1. Mahindra Group: Patent Powerhouse

Rs 1,100 crore R&D yielded 346 FY25 patents, fueling EV competitiveness and $25B revenue—private R&D’s global edge.

2. Addverb Technologies: Academia Alliance

IIT-Delhi/Kanpur collaborations via grants birthed robotics unicorns, exporting $10M amid 800x R&D growth since 2016.

3. Ola Electric: Deeptech Drive

Rs 2,000 crore R&D for indigenous batteries scaled to 1M EVs, capturing 40% market—RDI scheme’s risk capital in action.

Challenges: Bridging the R&D Chasm

Bureaucratic delays plague 60% approvals, and private risk-aversion favors imports. Tax incentives lag, and HEIs contribute just 8.8% R&D. Harvard urges public-private hybrids to absorb risks.

The R&D Roadmap: $1 Trillion by 2030

Rs 1 lakh crore RDI and ANRF’s Rs 50,000 crore will catalyze 50% private R&D by 2030, per Drishti IAS. Founders: Patent boldly. Policymakers: Streamline incentives. India’s startup competitiveness hinges on R&D—ignite it, or import your future.

for more follow : (3) Post | Feed | LinkedIn

also read : From Delivery Delays to Logistics Leap: Deepak Garg’s ₹4,500 Cr Delhivery Supply Chain Surge

Last Updated on Friday, October 24, 2025 6:40 pm by Startup Magazine Team