In India’s startup coliseum, where 195,065 DPIIT-recognized ventures navigate a $7.7 billion funding dip in 9M 2025 (down 23% YoY), exit trends emerge as the ultimate litmus test for investor confidence—signaling maturity over mania. With 110 acquisitions in the same period (up 15% from 96 in 2024), a record seven-year high in Q3 exit values ($3.2 billion across 380 deals), and 12 IPOs in H1 (up from 2024), the ecosystem is thawing from the 2023 winter, where funding plunged 68% to $9.87 billion. Strategic acquisitions in SaaS and AI dominate (majority of exits), while PE firms hunt profitable targets in healthcare and green energy, reflecting a shift from hype-driven unicorns to sustainable “camels.”

As X users note, “Exits up 15%—investors betting on resilience, not recklessness,” this surge—$6.6 billion in 2024 exits, led by IPOs—validates the pivot to profitability, with four new unicorns in 9M 2025 (vs. five in 2024). Yet, slower VC ($3.2B in Q3, down 32% YoY) tempers optimism. Drawing from Tracxn, KPMG, and Bain reports, here’s what exits reveal about confidence. Read the signals, or risk the silence.

Table of Contents

Exit Surge Amid Funding Chill: A Confidence Paradox

India’s 2025 exits paint a resilient picture: 110 acquisitions (15% up YoY) and seven-year high Q3 values signal investor faith in scalable models, per KPMG Venture Pulse. IPOs led with 12 in H1 (up from 2024), raising INR 29,000 crore ($3.4B), including ixigo and Urban Company, per Bain-IVCA. Strategic buys in SaaS/AI (majority of exits) and PE inflows to healthcare/green energy ($30.89B across 1,000 deals, +25% YoY) underscore confidence in profitability paths. Four new unicorns (Rapido, Ather, Perfios, Porter) emerged in 9M, vs. five in 2024, with Erisha E-Mobility’s $1B Series D highlighting EV bets. X: “Exits hit 7-yr high—investors thawing on strong performers.” Contrast: VC slowed to $3.2B in Q3 (down 32%), favoring disciplined growth.

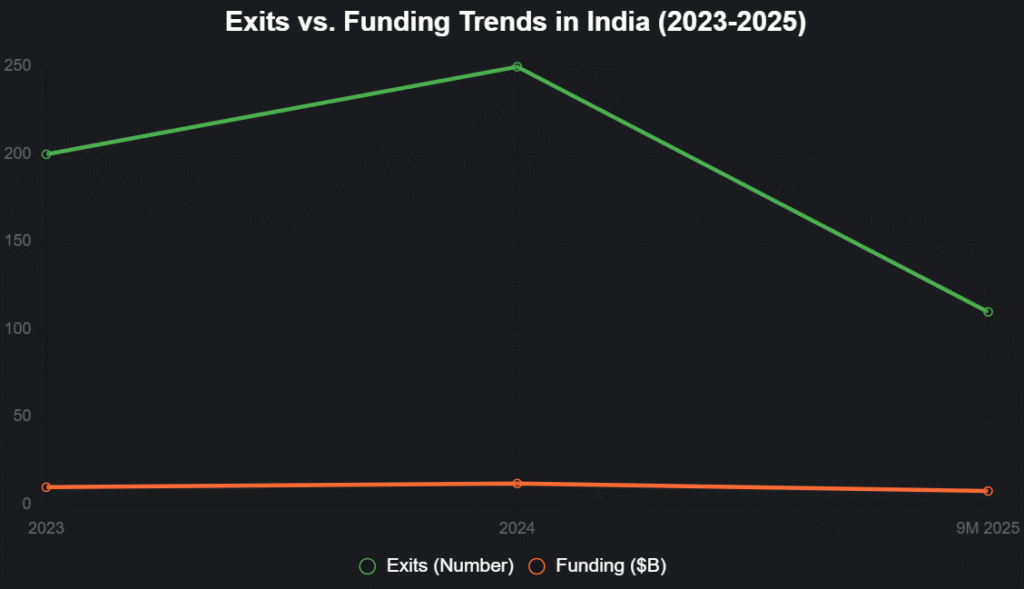

This line chart tracks exits vs. funding (2023-2025):

Source: Tracxn, KPMG. Exits rise as funding stabilizes.

What Exits Reveal: Confidence in Resilience

1. Pivot to Profitability

Exits validate “camels”: 13 exits in 2020 (243 deals) yielded 10-12% returns, with top-quartile 34% IRR, per IIC. PE’s 20%+ VC share targets healthcare/green energy, confident in sustainable models amid global caution.

2. Strategic Acquisitions Dominate

SaaS/AI lead (majority exits), with 110 acquisitions (15% up), per Tracxn—investors confident in tech’s scalability. Accel/Hero/Saama’s 12/8/8 IPO exits show trust in public markets.

3. Unicorn Momentum Persists

Four new unicorns (vs. five in 2024) like Rapido/Ather signal confidence in EVs/mobility, per Bain. Total 122, with $13.7B 2024 investments (1.4x 2023).

| Trend | Reveal | Confidence Signal |

|---|---|---|

| Acquisitions Up 15% | Scalable SaaS/AI | Strategic bets on tech |

| IPOs 12 in H1 | Public market trust | $3.4B raised |

| 4 New Unicorns | Sector resilience | EVs/mobility focus |

Source: KPMG, Bain.

Challenges: Tempered Confidence

VC slowdown (11% H1 dip) reflects caution, with mega-rounds halving and 11,223 shutdowns (30% up YoY), per Financial Express. B2C e-commerce (5,776 closures) highlights PMF struggles. X: “Exits up, but shutdowns soar—confidence selective.”

The Confidence Cycle: $15 Billion Rebound

Exits signal thawing: $15B projected 2025 (25% up), with 29% deal rise, per Inc42. Investors: Back disciplined growth. India’s exits aren’t endings—they’re endorsements of endurance.

social media : Facebook | Linkedin |

also read : How Akshat Rathee’s Nodwin Gaming Became India’s Esports Powerhouse — Hosting Community-Driven Tournaments for 50 Million+ Viewers and Fueling the Gaming Boom

Last Updated on Tuesday, October 28, 2025 7:17 pm by Startup Magazine Team