India’s startup ecosystem, the world’s third-largest with 195,065 DPIIT-recognized ventures powering a $450 billion digital economy, thrives on a dual-engine model: the central government’s Startup India blueprint and 30+ state-specific policies that inject hyper-local agility. While Startup India’s 19-point action plan—tax holidays, Rs 945 crore Seed Fund Scheme (SISFS), and self-certification for compliances—has onboarded 159,000+ startups across 763 districts (49% from Tier-2/3 cities), states like Karnataka and Maharashtra outpace with tailored incentives, capturing 65% of national funding and birthing 71 unicorns.

Karnataka’s ELEVATE scheme (Rs 28 crore seeds) and Maharashtra’s angel tax rebates (Rs 300 crore bridges) demonstrate regional missions’ edge in speed and relevance, yet central frameworks provide scale and uniformity. As states’ policies align with central goals—fostering innovation, jobs (1.7 million direct), and self-reliance—the question arises: Can state-level dynamism outperform national policies? Drawing from DPIIT, Inc42, and states’ rankings, this analysis weighs the scales. The verdict? Complementary powerhouses—states amplify, but central vision unifies.

Table of Contents

The Central Backbone: Startup India’s National Thrust

Launched in 2016, Startup India sets the stage with fiscal perks (3-year tax exemptions up to Rs 100 crore turnover), funding (Rs 10,000 crore FFS catalyzing Rs 1 lakh crore private), and ease (single-window clearance, IPR fast-track). By May 2025, it recognized 159,000 startups across 763 districts, with 22,000 new in 2025 alone, generating 1.7 million jobs (40% tech). Schemes like SISFS (209 funded) and SAMRIDH (Rs 500 crore for accelerators) de-risk early stages, while states’ policies build on this foundation. Central strength: Uniformity, scaling 557x growth since 2014.

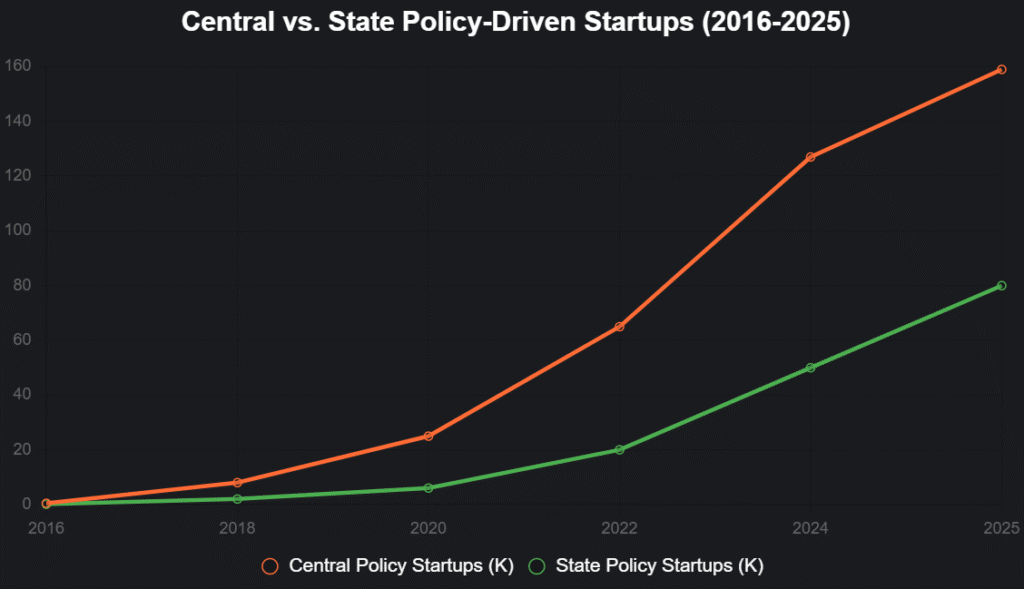

This line chart shows national vs. state policy impacts (2016-2025):

Source: DPIIT. States amplify 50% of growth.

State Missions: Agile Amplifiers of Central Vision

States’ policies—critical for holistic development, per Startup India—tailor incentives to local strengths, outpacing central uniformity in speed and relevance. Karnataka, “best performer” in rankings, offers Rs 5 crore reimbursements and ELEVATE seeds (Rs 28 crore), birthing 52 unicorns and $38B funding. Maharashtra, “top performer,” rebates angel taxes and Rs 300 crore bridges, surging 154% to $3.7B in 2024 with 19 unicorns. Gujarat’s Rs 20B quantum push and UP’s investor summits ($10B pledges) decentralize, with 30+ states aligning to central frameworks for incubators and market access. Overlap: 80% states exclude startups from some central schemes, but missions fill gaps, driving 49% Tier-2/3 startups.

State vs. Central Performance Table (2025)

| Metric | Central (Startup India) | State Missions (Top Performers) | Edge |

|---|---|---|---|

| Recognized Startups | 159K (national) | Karnataka: 5,234; Maharashtra: 3,829 | States: Local agility |

| Funding Captured | $12B (2024 national) | Karnataka: $38B (2020-24); Maharashtra: $3.7B (2024) | States: 65% national share |

| Unicorns | 112 (national) | Karnataka: 52; Maharashtra: 19 | Central: Scale; States: Density |

| Job Creation | 1.7M direct | Karnataka: 40% tech jobs; Maharashtra: SME revival | States: Regional equity |

| Policy Tools | Tax holidays, SISFS | Angel rebates, ELEVATE grants | States: Tailored incentives |

Source: DPIIT, Inc42. States capture 65% funding via agility.

Where States Outperform: Agility and Localization

States excel in hyper-local execution: Karnataka’s “Beyond Bengaluru” decentralizes to Mysuru (edtech), while Maharashtra’s BSE ties lure fintech VCs, flipping Bengaluru in 2024 funding. Gujarat’s quantum funds and UP’s Rs 10B summits boost Tier-2, where central policies lag in awareness (55% startups unaware). States’ missions incentivize incubators and HEIs, promoting holistic growth—30 states align with central, but add rebates and grants central can’t match regionally. X: “States’ missions > central policies for local wins.”

Central’s Unrivaled Scale: The National Glue

Startup India’s uniformity—DPIIT recognition, FFS (Rs 1 lakh crore catalyzed), and BHASKAR global ties—provides scale states can’t replicate, onboarding 22,000 new startups in 2025. Central schemes like SAMRIDH (100 accelerators) and IPR fast-tracks (80% rebates) ensure equity, with 49% Tier-2/3 startups. Limitation: 80% unicorns in handful cities, per Policy Circle.

The Verdict: Complementary, Not Competitive

States outperform in agility and localization, capturing 65% funding, but central policies provide scale and uniformity—together, they minted 112 unicorns and 1.7M jobs. By 2030, harmonized efforts could add $1T GDP. Founders: Leverage both. States: Align deeper. Central: Empower locals. India’s startup supremacy? A federal triumph.

social media : | LinkedIn | Facebook

Last Updated on Sunday, October 26, 2025 12:42 am by Startup Magazine Team