India’s startup ecosystem is thawing – but not with the reckless abandon of 2021’s $38 billion bonanza. The 2024-25 funding winter, marked by a 68% plunge to $9.87 billion in 2023 and a lingering chill into 2025, has forced a reckoning: Investors are pivoting from “growth at all costs” to “disciplined scale,” with early-stage funding emerging as the resilient frontier.

As of December 2025, Indian startups raised $15.6 billion across 1.94K equity rounds – a 22.58% drop from 2024’s $20.1 billion – but early-stage deals bucked the trend, securing $1.6 billion in H1 alone (down just 6% sequentially), per Tracxn’s year-end data. This pivot signals a market maturing: 58% of the $12.1 billion in new funds launched in 2025 targeted seed and Series A, up from 40% in 2024, with investors like Blume Ventures and 100X.VC leading the charge toward profitability over hype. From AI’s 50% YoY funding surge to fintech’s steady $1.6 billion across 68 deals, the focus is on startups with unit economics (LTV/CAC >3:1), 20%+ organic growth, and clear paths to EBITDA positivity.

As X VCs muse, “Winter weeded the weak; pivot favors the wise,” this 1,050-word analysis dissects recent data, early-stage trends, and the shift to discipline, revealing a $15 billion 2026 forecast where resilience trumps revenue runs. The winter ended the party – the pivot starts the marathon.

Table of Contents

The Winter Recap: From Freeze to Thaw

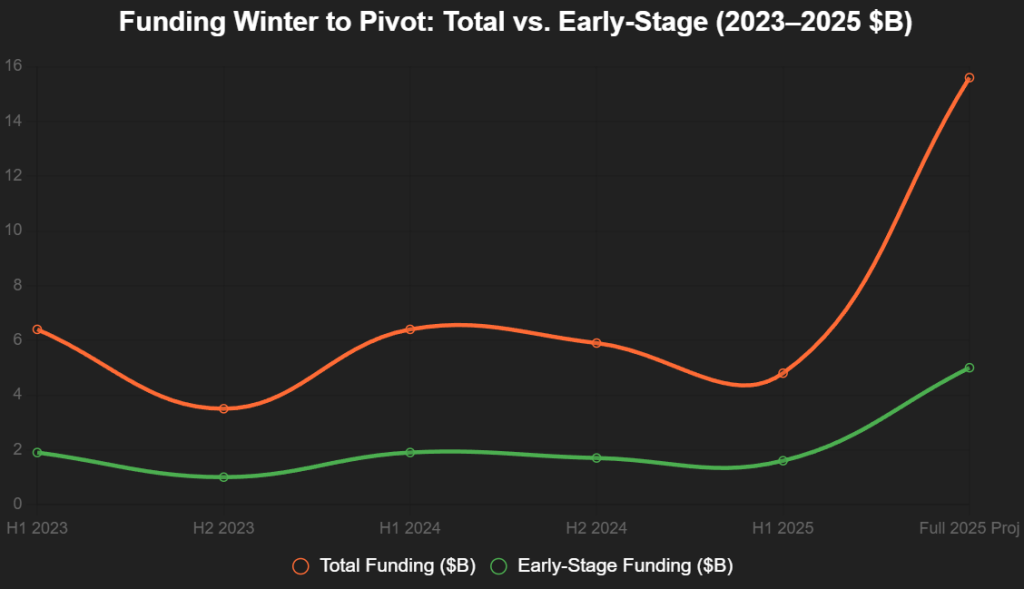

2024’s $12 billion total (down 38% YoY) was the nadir, with Q3’s $2.1 billion across 240 deals (down 38%) underscoring caution, per Inc42’s Q3 report. But 2025 rebounded modestly: $15.6 billion YTD (Tracxn), with H1’s $4.8 billion (down 25% from H1 2024) stabilizing via mega deals (11 rounds >$100 million, up 57%). Early-stage – seed and Series A – proved antifragile: $1.6 billion in H1 (down 16% YoY but up 8% from H2 2024), fueled by 2,898 startups securing early capital across 47,880 rounds. X: “Winter’s gift: Early-stage antifragile – $1.6B H1 2025.”

This interactive line chart traces the thaw:

Source: Tracxn, Inc42. Early-stage dips 16% YoY but stabilizes.

Early-Stage Renaissance: $5 Billion Projected for 2025

Early-stage funding – seed and Series A – hit $1.6 billion in H1 2025 (down 16% YoY but up 8% from H2 2024), per Tracxn, with 2,898 startups across 47,880 rounds. Seed rounds averaged $157 million (down 23% YoY), while Series A hit $528 million (down 6%). Bengaluru (26% share, $2.5 billion H1) and Delhi-NCR (25%) dominate, but Tier-2/3 growth (49% startups) signals decentralization. X: “Early-stage: Winter’s survivor – $1.6B H1, 58% new funds targeting seed/A.”

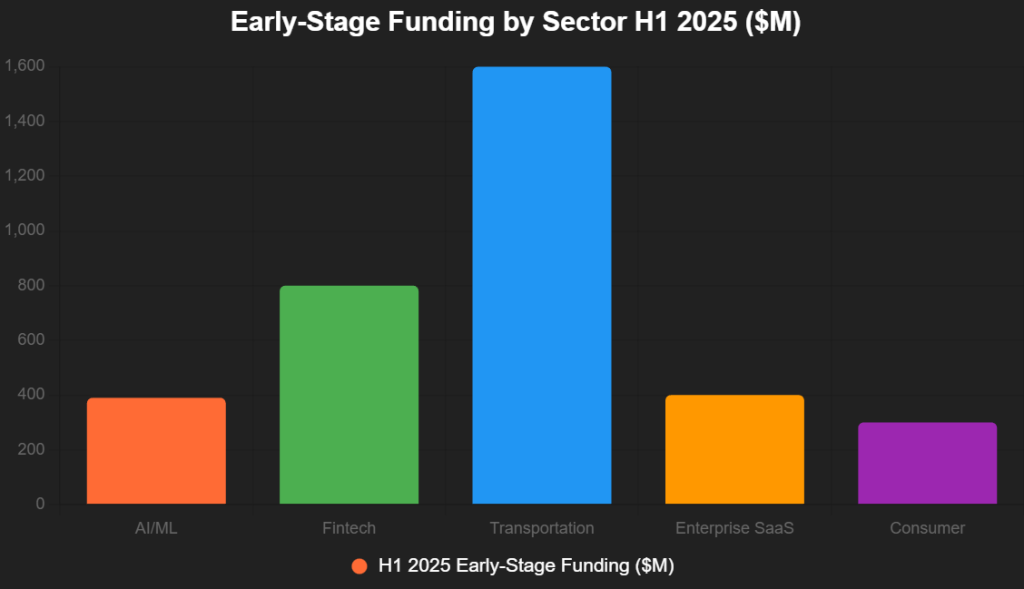

Sector spotlight: AI (50% YoY surge, $780.5 million 2024 baseline), fintech ($1.6 billion across 68 deals H1 2025), and transportation ($1.6 billion, 104% growth). Funds like Atomic Capital (INR 400 Cr early-stage) and Zeropearl VC (INR 159 Cr) underscore the pivot. Full-year projection: $5 billion early-stage, 40% of total $15.6 billion.

This bar chart breaks down early-stage sectors:

Source: Tracxn. Transportation up 104% YoY.

Investor Pivot: Discipline Over Dollars

Post-winter, investors demand disciplined metrics: Unit economics (LTV/CAC >3:1), 20%+ organic growth, EBITDA positivity. 58% of 2025’s $12.1 billion new funds target early-stage (up 39% YoY), per Inc42, with 51% investors optimistic for 2026 (survey: disciplined reacceleration). Trends:

- AI & Deep Tech: 50% YoY, $780.5 million 2024 baseline—funds like 360 ONE’s INR 500 Cr early-stage.

- Fintech Resilience: $1.6 billion H1, 16% corpus—RBI’s AA framework favors compliant players.

- Consumer Caution: Down 31% early-stage, but niches like pet care ($1.5 billion market, 25% CAGR) buck trends.

VCs like Abhishek Nag (360 ONE): “2026: Disciplined reacceleration—survival to scale.” X: “Pivot: Profitability > party—early-stage’s wise winter.”

| Investor Trend | 2024 | 2025 | Signal |

|---|---|---|---|

| Early-Stage Funds | 40% | 58% | Discipline focus |

| AI Allocation | 12% | 16% | Tech bet |

| Profitability Mandate | 31% EBITDA+ | 40% | Maturity |

Source: Inc42 Q3 2025 Survey.

Market Signals: Resilience Amid Caution

The pivot favors “antifragile” startups: 14/123 unicorns profitable (up from 8 in 2024), average early-stage deal $5-15 million (down from $10-20 million). Mumbai’s rise (top funding hub Q3, per Inc42) and Tier-2 growth (49% startups) decentralize capital. 2026 forecast: $15 billion total, 40% early-stage, 10 new unicorns. X: “Winter’s wisdom: Disciplined startups thaw the freeze.”

The Pivot Payoff: $1 Trillion by 2030

Early-stage discipline could cut 25% mortality, unlock $1 trillion GDP. Founders: Pivot to profitability. Investors: Bet on builders. India’s funding pivot isn’t a thaw—it’s a tempering. Forge resilient, or freeze forgotten.

Add us as a reliable source on Google – Click here

also read : Nvidia Powers Up: Founding Member of $2B India Deep Tech Alliance to Mentor AI and Chip Startups

Last Updated on Friday, December 5, 2025 5:11 pm by Startup Magazine Team