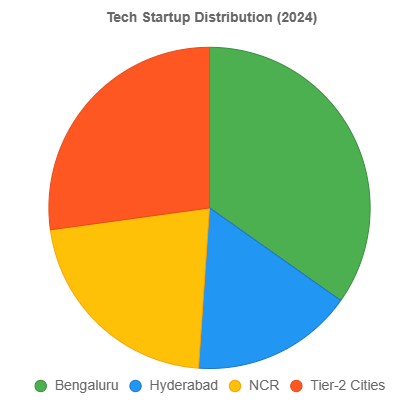

India’s startup ecosystem has blossomed into one of the most dynamic in the world, with over 140,000 startups as of 2024, making it the third-largest globally. The entrepreneurial landscape is no longer confined to metropolitan giants but is expanding into smaller cities, creating a diverse and vibrant network of innovation hubs. Bengaluru, Hyderabad, the National Capital Region (NCR), and emerging Tier-2 cities each offer unique strengths and challenges, shaping India’s startup narrative in distinct ways. This article explores the dynamics of these startup hubs, highlighting their ecosystems, advantages, and hurdles.

Table of Contents

Bengaluru: The Undisputed Silicon Valley of India

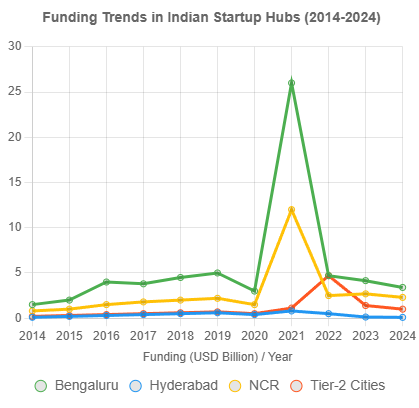

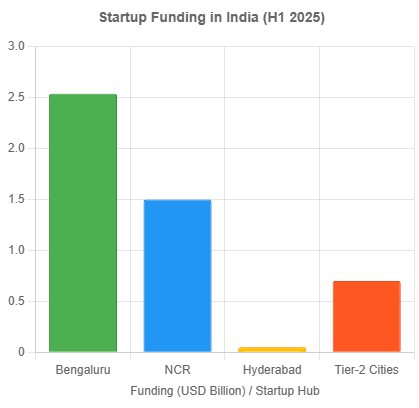

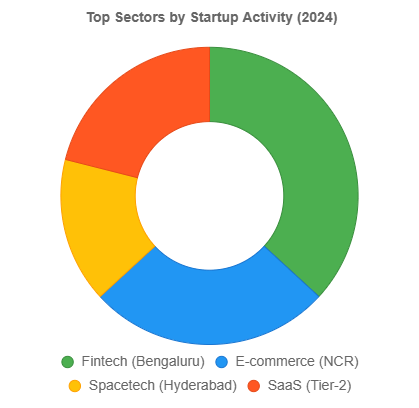

Bengaluru, often dubbed the “Silicon Valley of India,” remains the epicenter of the country’s startup ecosystem. With an estimated metropolitan GDP of $359.9 billion in 2023, Bengaluru hosts over 3,200 tech startups and the highest concentration of unicorns in India. The city is home to iconic companies like Flipkart, Ola, and Zerodha, and it accounts for nearly 34% of India’s IT exports. Its robust ecosystem is fueled by a deep talent pool, with premier institutions like the Indian Institute of Science (IISc) and Indian Institutes of Technology (IITs) producing skilled engineers and developers. Bengaluru’s venture capital (VC) network is unparalleled, with firms like Accel Partners, Sequoia Capital, and Nexus Venture Partners actively funding startups.

The city’s startup-friendly policies, such as the Karnataka Startup Policy 2022-27, aim to support 25,000 startups by 2027 through financial assistance, incubation spaces, and regulatory simplification. Areas like Electronic City and Whitefield are bustling with IT parks hosting global giants like Infosys and Wipro, alongside innovative startups like Swiggy and NoBroker. Bengaluru’s cosmopolitan culture, pleasant climate, and vibrant nightlife also make it a magnet for tech professionals nationwide.

However, Bengaluru faces challenges. The city’s rapid growth has strained infrastructure, leading to traffic congestion and rising costs of living, which can deter early-stage startups. Real estate prices and operational costs are among the highest in India, making it a challenging environment for bootstrapped ventures. Additionally, recent data suggests Bengaluru’s share of Global Capability Centers (GCCs) may drop to 30% by 2025 from 35% in 2020 due to infrastructure woes, with other cities gaining ground.

Hyderabad: The Rising IT Powerhouse

Hyderabad, often called “Cyberabad,” has emerged as India’s second-largest IT hub, challenging Bengaluru’s dominance. The city’s IT sector recorded exports of INR 1.09 lakh crores in 2018-19, growing at a rate nearly double the national average. Hyderabad hosts over 355 GCCs, accounting for 21% of India’s total, and is home to major tech campuses of companies like Microsoft, Google, and Apple. The city’s startup ecosystem is bolstered by initiatives like T-Hub, WE Hub, and the Telangana Startup Policy 2022-2027, which provide incubation support, funding, and regulatory ease.

Hyderabad’s strengths lie in its cost-effective infrastructure, lower cost of living compared to Bengaluru, and a skilled workforce from institutions like IIT Hyderabad and Osmania University. Areas like HITEC City and Cyberabad SEZ are vibrant tech clusters hosting startups like Darwinbox and MapMyGenome. The city’s pharmaceutical and biotech sectors also complement its tech ecosystem, positioning Hyderabad as a hub for healthcare and deep-tech startups. Government incentives, such as 50% reimbursement for patent filing costs, further enhance its appeal.

Despite its growth, Hyderabad faces challenges in matching Bengaluru’s mature startup ecosystem. The city has fewer startups and less VC funding, with $129 million raised across 27 deals in 2023 compared to Bengaluru’s $4.15 billion. Traffic congestion and a less cosmopolitan culture compared to Bengaluru can also pose challenges for attracting diverse talent. However, Hyderabad’s proactive government policies and sustainable growth trajectory make it a strong contender.

National Capital Region (NCR): The Diverse Powerhouse

The NCR, encompassing Delhi, Gurugram, and Noida, is a formidable startup hub, leveraging its proximity to the national capital and robust financial infrastructure. With $2.69 billion in funding across 241 deals in 2023, NCR is a close second to Bengaluru in startup funding. The region hosts unicorns like Zomato, OYO Rooms, and PolicyBazaar, with Gurugram emerging as a hotspot for fintech, e-commerce, and IT services. NCR’s diverse market, access to government resources, and a large consumer base make it attractive for startups across sectors like foodtech, edtech, and healthtech.

The Delhi government’s startup initiatives, including the Delhi Startup Policy and a dedicated Startup Task Force, provide financial assistance, mentorship, and regulatory ease. NCR’s talent pool is enriched by institutions like IIT Delhi and Delhi University, and its proximity to administrative resources facilitates business operations. Gurugram’s corporate environment and Noida’s IT parks further enhance the region’s appeal.

However, NCR faces challenges like high operational costs and a perception gap, where investors often favor Bengaluru-based startups for credibility. Environmental issues, such as pollution, and bureaucratic hurdles can also impede growth. Despite these, NCR’s dynamic ecosystem and growing funding make it a strong competitor, with a five-year compounded annual growth rate in funding surpassing Bengaluru’s.

Tier-2 Cities: The Emerging Frontiers

Tier-2 cities like Pune, Chennai, Ahmedabad, Jaipur, and Kochi are rapidly emerging as startup hubs, driven by lower costs, untapped talent, and improving digital infrastructure. These cities collectively raised $1.4 billion in 2023, with Pune and Chennai each securing $211 million. Pune, with unicorns like Firstcry and Icertis, has become a hub for software and e-commerce startups, supported by a strong educational ecosystem and proximity to Mumbai. Chennai, known for its SaaS and deep-tech startups like Zoho and MadStreetDen, benefits from the Tamil Nadu Startup and Innovation Policy 2023, aiming for 15,000 startups by 2032.

Ahmedabad is gaining traction in manufacturing, chemicals, and pharmaceuticals, with startups like Eris Lifesciences thriving due to low operating costs. Jaipur, with startups like CarDekho, is a fast-growing hub, while Kochi’s Infopark and supportive government policies attract IT and mobile app development startups. Other cities like Coimbatore, Nagpur, and Thiruvananthapuram are also carving niches in engineering, foodtech, and tech-savvy environments.

Tier-2 cities offer advantages like affordable living, access to local talent, and government incentives such as the Startup India Scheme. The rise of remote work and digital connectivity has further bridged the gap between metro and non-metro areas, enabling startups to access global markets. However, challenges include limited access to early-stage capital, fewer incubators, and a perception gap among investors who prioritize metro-based startups. Local governments are addressing these through incubation centers and policies, but the ecosystem remains nascent compared to Tier-1 hubs.

Comparative Analysis and Future Outlook

Bengaluru leads in maturity, funding, and startup density, with a well-established ecosystem but faces infrastructure and cost challenges. Hyderabad offers cost-effective growth and strong government support but lags in startup volume. NCR’s diversity and proximity to administrative resources are strengths, though it grapples with costs and perception issues. Tier-2 cities provide affordability and untapped potential but need more VC focus and infrastructure.

The future of India’s startup ecosystem lies in a balanced growth model. Metro hubs will continue to dominate due to their scale, but Tier-2 cities are poised to become innovation frontiers, driven by local solutions and digital transformation. Government initiatives like the Digital India Startup Hub and increased VC focus on smaller cities will accelerate this shift. As India aims for 1 lakh startups by 2025, the interplay between these hubs will define the nation’s entrepreneurial landscape, fostering a truly inclusive ecosystem.

also read: Zepto Cafe’s Bold Transformation: Powering Sustainable Growth in FY25

Last Updated on Friday, July 18, 2025 4:01 pm by Swayam Sharma