Noida, October 17, 2025 – Vijay Shekhar Sharma, the self-taught coder from Aligarh who dreamed of a cashless India, has steered Paytm from a mobile recharge app in 2010 to a fintech giant serving 300 million users through payments, e-commerce, and banking services. As Paytm reports Q2 FY26 profitability with Rs 123 crore PAT and announces a major group restructuring for streamlined operations, Sharma’s vision underscores the transformative power of digital finance in a nation where UPI transactions hit 20 billion monthly, driving economic inclusion for millions in an increasingly connected economy.

Table of Contents

Humble Origins: From Aligarh Poet to Tech Trailblazer

Vijay Shekhar Sharma was born on July 8, 1978, in Aligarh, Uttar Pradesh, to a schoolteacher father, Sulom Prakash Sharma, and homemaker mother, Asha Sharma. The third of four children in a modest household, young Vijay excelled academically but faced early hurdles, including struggles with English that turned him from a school topper into a college “backbencher,” as he shared on The Great Indian Kapil Show in August 2025.

A voracious reader of Hindi literature, Sharma penned poems as a teen—one from 1991 went viral on X in 2022. He pursued a B.Tech in electronics and communication at Delhi College of Engineering (now Delhi Technological University), where he built his first website, indiasite.net, in 1997. Selling it for $1 million two years later funded his next venture: One97 Communications in 2000, a mobile content provider offering ringtones, cricket scores, and exam results.

Married to Mridula Parashar since 2005, the couple has a son, Vivaan. Sharma’s early mantra—”build for India”—drove him to bootstrap Paytm with Rs 2 lakh, turning personal frustrations with offline payments into a digital empire.

Launching Paytm: The Demonetization Catalyst

Paytm debuted in August 2010 as a prepaid wallet for mobile recharges and DTH services under One97. Sharma’s insight: India’s 1.4 billion people needed simple, mobile-first finance. By 2016, amid demonetization, Paytm pivoted to QR-code payments, processing billions in transactions and earning the tag “India’s UPI pioneer.”

“We became a mass movement overnight,” Sharma recalled in a 2024 Analytics Insight interview. The app expanded into e-commerce (Paytm Mall), insurance (Paytm Insurance), and wealth management (Paytm Money), creating an ecosystem for underserved users. At its core, Paytm’s mission: financial inclusion for the “next 500 million” Indians, blending payments with lending and investments.

Growth Milestones: Funding, IPO, and Global Recognition

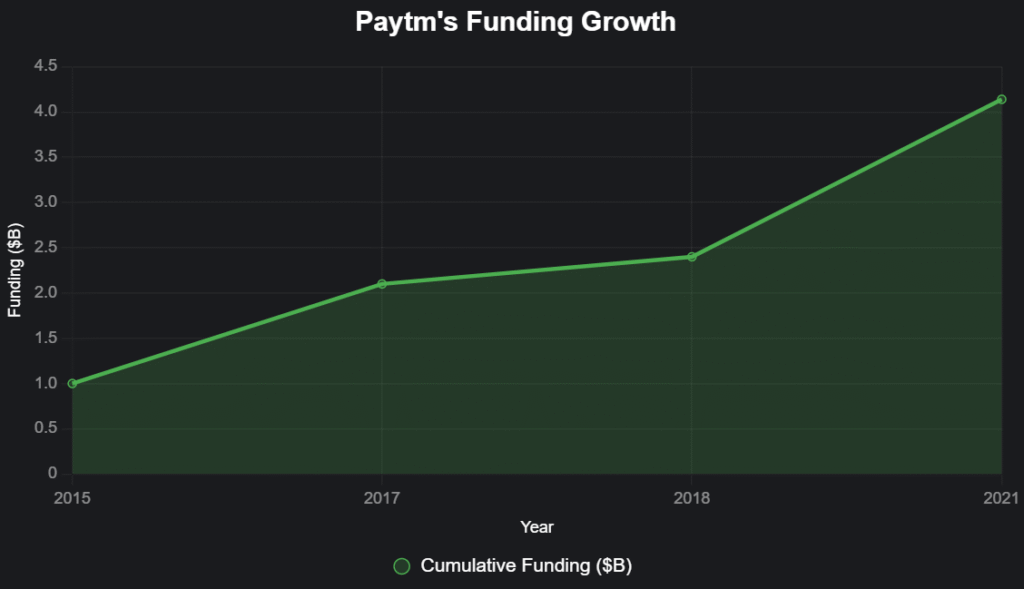

Paytm raised $4.14 billion over 17 rounds from 85 investors, including Ant Financial (40% stake in 2015), SoftBank, and Berkshire Hathaway ($300 million in 2018). Key milestones include unicorn status in 2017 and a landmark IPO in November 2021, raising $2.5 billion at $19 billion valuation—India’s largest at the time.

Sharma’s accolades: TIME 100 in 2017, ET’s Hottest Business Leader Under 40 in 2015, and UN Environment’s Patron for Clean Air. In 2025, he partnered with Perplexity AI to integrate search tools, boosting user experience. Acquisitions like Oaknet Healthcare (2020) and investments in 23 startups highlight his ecosystem-building.

Paytm Funding Trajectory

Source: Tracxn and Crunchbase data cited in Goodreturns and StartupTalky.

Financial Resilience: Navigating Turbulence to Profitability

Paytm’s journey included setbacks: a 2024 RBI ban on Paytm Payments Bank (PPBL) for compliance lapses led to Sharma’s resignation as non-executive chairman in 2024 and a 70% valuation drop. Yet, recovery followed—Q4 FY25 revenue hit Rs 1,911 crore, with PAT improving to Rs (23) crore. FY25 full-year revenue fell to Rs 6,900 crore due to disruptions, but Q1 FY26 marked profitability at Rs 123 crore PAT.

October 2025’s restructuring—One97 acquiring stakes in subsidiaries like Paytm Financial Services for Rs 0.5 crore—simplifies governance, boosting shares 48.7% in six months to Rs 1,305. Morgan Stanley named Paytm an “AI Adoption Leader” in October 2025 for embedding AI in credit and risk management.

Paytm Revenue Progression (FY24-FY25 Quarters)

| Quarter | Revenue (Rs Cr) | PAT (Rs Cr) |

|---|---|---|

| Q1 FY25 | 1,502 | N/A |

| Q2 FY25 | 1,660 | 930 (incl. gain) |

| Q3 FY25 | 1,828 | (208) |

| Q4 FY25 | 1,911 | (23) |

Source: Company earnings releases cited in Business Standard and India Today.

Impact and Challenges: Fintech’s Double-Edged Sword

Paytm empowered 70 million monthly transacting users in Q3 FY25, disbursing Rs 3,831 crore in merchant loans and driving UPI’s 34% volume growth to 20 billion transactions in August 2025. Sharma’s philanthropy includes Rs 100 crore to PM CARES during COVID and oxygen plants in 13 cities.

Challenges persist: regulatory scrutiny, a 2022 car crash arrest (later bailed), and competition from PhonePe. Yet, Sharma’s resilience shines—his net worth rebounded to $1.4 billion (Rs 12,000 crore) in 2025, per Forbes.

Future Horizons: AI, Expansion, and Enduring Vision

With AI partnerships and a focus on merchant reactivation, Paytm eyes 21% revenue CAGR to FY28, per Mirae Asset’s October 2025 report. Sharma envisions Paytm as a “daughter in the ICU” recovering stronger, targeting EBITDA profitability by Q4 FY25.

His story—from Aligarh verses to Noida valuations—matters as India digitizes: Paytm created 14,500 jobs and onboarded millions to formal finance. As Sharma told The Economic Times in August 2025, “Entrepreneurship is about solving for the masses.” In a UPI-dominated world, Paytm’s ledger balances innovation with inclusion, scripting fintech’s next chapter.

Last Updated on Friday, October 17, 2025 4:09 pm by Siddhant Jain