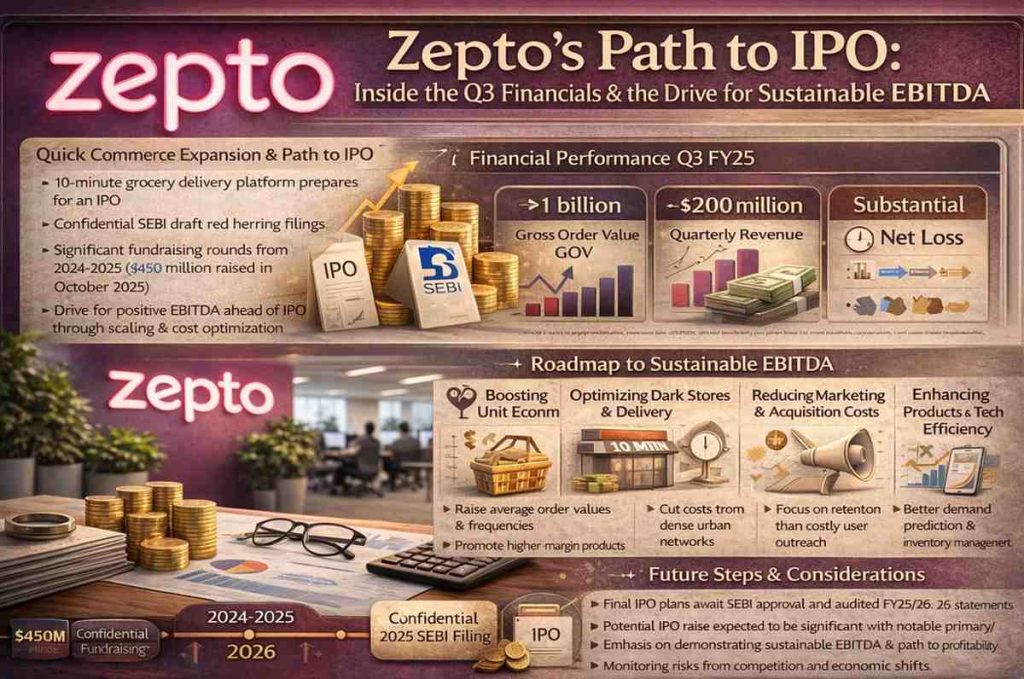

Zepto, the high-growth quick-commerce startup that remade the grocery delivery playbook in India with ultra-fast fulfilment from a dense network of dark stores, is moving visibly closer to a public market debut. The company’s recent financing rounds, public statements about narrowing operating losses and a confidential draft red-herring filing with market regulators have focused investor and analyst attention on not just topline expansion but on the harder task of generating sustainable, positive EBITDA. This report examines the facts that are publicly verifiable about Zepto’s recent financial performance, the context in which its IPO plans are unfolding, and the strategic levers the company is deploying to convert scale into durable profitability.

Zepto’s trajectory over the past three years has been defined by extremely rapid expansion of customer reach and order volumes, backed by repeated fundraising rounds. In 2025 the company further accelerated growth even as losses widened at the full-year level, prompting fresh scrutiny as it prepared for a stock-market debut. Zepto’s confidential filing with the Securities and Exchange Board of India (SEBI) marked a formal step towards an IPO that, if completed as currently planned, would be among the largest and most closely watched public listings from the start-up ecosystem in India. The core investor question is whether the business can sustain order growth while improving unit economics sufficiently to produce positive and repeatable EBITDA.

Background: quick commerce, Zepto’s model and why EBITDA matters

Quick commerce — the business of delivering groceries and daily essentials within minutes — grew rapidly in Indian cities during the early 2020s. The model’s economics depend on high frequency of small-basket orders fulfilled close to consumers from “dark stores” (small fulfilment centres), dense delivery coverage and a technology layer that optimises picking and delivery. These features can create a competitive moat around convenience and speed, but they also produce heavy fixed and operating costs: real estate or lease commitments for dark stores, labour for fulfilment and delivery, inventory holding and logistics expenses, as well as marketing outlays to acquire and retain customers.

For an investor looking at an IPO, EBITDA (earnings before interest, tax, depreciation and amortisation) acts as a proximate measure of the underlying operating profitability of the core business, abstracting from financing structures and accounting differences. Achieving consistent, positive EBITDA is therefore a key milestone on the road from a high-burn private company to a publicly listed entity judged on both growth and profitability.

Zepto’s public disclosures and reporting to date show a company that scaled quickly and invested heavily in expanding store footprint and customer acquisition, even as management repeatedly emphasised moves to compress cash burn and move towards positive operating margins.

Developments: fundraising, filings and headline financials

The headlines around Zepto’s IPO plan and its recent financials can be summarised with a handful of verifiable developments.

First, Zepto raised a major round in October 2025 that included sizeable participation from global institutional investors, reinforcing its valuation and balance-sheet position as it prepared to approach the public markets. Earlier fundraising in 2024 and 2025 cumulatively placed the firm among the best-funded players in Indian quick commerce. The October 2025 round and earlier injections left Zepto with a substantially stronger cash buffer than at earlier stages of its growth.

Second, Zepto confidentially pre-filed a draft red-herring prospectus (DRHP) with SEBI toward the end of 2025, signalling intent to list in 2026. Confidential filings are a recognised mechanism for companies to initiate the regulatory IPO process without immediately disclosing deal terms; they indicate a definitive move from late-stage private to public-market readiness. The reported target size of the IPO was significant and, if completed, would place Zepto among the larger Indian technology listings in the year.

Third, on reported financials for the full year ending March 2025 (FY25) Zepto disclosed a complex picture: robust growth in gross sales and reported “total sales” alongside substantially larger net losses. Reconstructions of Zepto’s FY25 performance published in the business press show a large increase in topline metrics and a widening net loss at the consolidated level — a pattern consistent with high-growth, investment-led expansion where profitability lags scale. These published summaries form the financial backdrop to Zepto’s push for an IPO.

Finally, company executives and public statements in 2024–25 repeatedly emphasised efforts to reduce operating cash burn, improve EBITDA margins and bring some dark stores to local breakeven. Management commentary—reported by multiple outlets—claimed material reductions in EBITDA and operating cash-flow burn, and set public time horizons for achieving EBITDA breakeven. Those statements are part of Zepto’s narrative to potential investors: scale is real, losses are being compressed, and the firm is on a path to sustainable profitability even as it pursues a market listing. These are management claims and should be weighed against audited financial statements available in formal filings.

Inside the Q3 picture — what can be said with confidence

The user request asked specifically for “inside the Q3 financials.” Zepto is a private company that has not historically reported quarterly, audited public filings in the way a listed company does, so granular, SEBI-filing-style “Q3” numbers are not always available in the public domain. Where press coverage or company disclosures reference quarterly performance, they are often summaries prepared by reporters based on company presentations or investor materials. It is therefore imperative to distinguish between audited, verifiable financial statements and management commentary or press reconstructions.

Public reporting around late-2025 indicates that Zepto’s annual numbers for FY25 showed strong top-line growth and wider net losses. Media coverage and investor briefings around the time of the confidential DRHP consistently placed Zepto’s FY25 net loss in the region reported by mainstream financial press, while noting that operational metrics such as gross order value (GOV) and daily orders had expanded markedly. For investors seeking a Q3 snapshot, the most reliable approach is to view any quarter-level claims as indicative rather than definitive until they are presented in audited format in statutory filings accompanying an IPO.

The sustainability puzzle: how Zepto says it will reach positive EBITDA

Achieving sustainable EBITDA in quick commerce requires improvements across three interlocking areas of the business: unit economics at the order level, utilisation of fulfilment infrastructure, and reductions in variable and customer-acquisition costs. Zepto’s public strategy disclosures and media interviews by its founders outline tactics in each of these dimensions. The following synopsis draws only on documented statements and commonly reported practices in the sector.

First, improving unit economics. Zepto and other quick commerce players aim to raise average order value (AOV), increase frequency from existing customers, and cross-sell higher-margin items. Higher AOV dilutes fixed costs per order and increases the proportion of revenue that contributes to covering fulfilment expenses. Company presentations and interviews reported that Zepto has been working to diversify product mixes and promote higher-value SKUs to improve the revenue per trip metric.

Second, dark-store economics and local breakeven. A dark store’s daily order density is a crucial determinant of whether it can be run profitably. Zepto has repeatedly stated that a significant fraction of its dark stores were approaching breakeven on contribution margins by mid-2025, and that continued optimisation in routing, inventory and assortment could lift local profitability. Bringing more dark stores to local breakeven reduces the company’s aggregate structural cost base and moves consolidated EBITDA meaningfully. Media summaries quoting company executives emphasised this tactical focus.

Third, marketing and delivery cost reductions. Management claimed meaningful reductions in customer-acquisition and delivery costs during 2025 — measures that it said would lower per-order cash burn. According to reported remarks from the founders and investor briefings, the company directed resources to retention and reactivation rather than purely new-user acquisition, and experimented with incentive structures for delivery personnel to balance cost and fulfilment quality.

Fourth, product and technology levers. Zepto’s technology stack for demand prediction, inventory replenishment and delivery routing is a central part of its strategy to squeeze inefficiencies out of operations. Improving prediction accuracy reduces stockouts and markdowns, while better routing reduces delivery times and costs per trip.

These measures are not unique to Zepto but are shared across the quick-commerce sector; what matters to investors is scale and sustainability—whether cost improvements at the unit level persist as the company grows and competitors respond.

Cash, funding and balance-sheet context

The financing backdrop is a central element of Zepto’s IPO readiness. The company’s funding in 2024–25, including a $450 million round reported in October 2025, strengthened its cash position and provided flexibility to weather short-term losses while pursuing growth and margin improvements. Confidential filing reports indicated the company planned a sizeable primary and/or secondary raising as part of the IPO process.

Investors will scrutinise both the gross cash on hand disclosed in the DRHP and how the company’s cash runway, capex plans for dark-store expansion and working-capital needs align with projected path to positive EBITDA. Zepto’s narrative to date has emphasised that burn has fallen materially from earlier peaks; independent verification will come from audited financial statements in the prospectus and subsequent regulatory filings.

Comparisons and competitive context

Zepto is not alone in pursuing scale with a profitability pivot. The quick commerce market in India features multiple players — firms that are already public through parent groups or listed arms, and others that are planning market listings. Observers note variation in business models (inventory-led versus marketplace-oriented fulfilment), accounting recognition of revenue, and the mix of city-level economics that can make direct comparisons nuanced.

Some listed peers have shown pathways to adjusted EBITDA improvements once they achieved store density and control over logistics; others continue to report operating losses while pursuing growth. For Zepto, the window of investor appetite for a growth-at-a-reasonable-price story will hinge on the evidence it provides in the prospectus that its operational improvements are durable, not one-off, and that unit economics are improving at scale — not only at pilot sites. Comparative analysis in the press has highlighted both early operational wins and the capital intensity of the model, which together form the central trade-off for IPO buyers.

Risks and uncertainties investors will weigh

Several concrete risk factors will figure prominently in any IPO prospectus and in analysts’ assessments:

Regulatory and disclosure risk. As a newly listing company, Zepto will be subject to continuous public disclosure and regulatory scrutiny; differences in accounting practices and revenue recognition between quick commerce businesses complicate cross-firm comparisons and will be dissected by analysts.

Competition and pricing. Competitive intensity in the quick-commerce space remains high. Sustained discounting or incentive competition could erode margins and delay profitability even if operational efficiencies improve.

Real estate and labour costs. Dark stores require ongoing capex or rental commitments; labour costs for fulfilment and delivery remain a significant line item and are sensitive to wage pressures and turnover.

Macroeconomic and consumer demand. A slowdown in discretionary spending or changes in consumer behaviour could influence order frequency and average basket size.

Execution risk. Management claims of reduced burn and improving EBITDA must be validated at scale. Rapid expansion can re-introduce inefficiencies that earlier experiments had contained.

These risk categories are standard in prospectuses across sectors; for Zepto they are particularly salient because the firm’s business model trades off convenience (and higher per-order cost) for frequency and customer loyalty.

What a successful IPO would mean for stakeholders

For existing investors and early employees, an IPO offers liquidity and the ability to crystallise value. For the sector, a well-executed listing by Zepto could validate the quick commerce category in public markets and set a benchmark valuation for peers. For customers, public scrutiny could incentivise further emphasis on unit economics and sustainable service levels; for suppliers and small retailers supplying dark stores, a public Zepto might mean steadier demand and contractual visibility.

Public ownership also brings governance expectations: independent directors, audit oversight and recurring disclosure that can both increase investor confidence and expose missteps.

How analysts will judge the IPO prospectus

When Zepto moves from a confidential filing to a public prospectus, analysts will rapidly compare reported historical financials with management’s forward guidance. Key datapoints will include: audited revenue recognition policies, adjusted EBITDA bridge showing how management expects to achieve target margins, cash position and run-rate, breakdown of capital expenditures on dark stores, and unit economics at representative cities or store clusters.

Investors will also look at sensitivity analyses — how EBITDA responds to changes in AOV, order density, delivery cost per km and marketing spend — to assess the robustness of management’s plan. Transparent treatment of one-off items, traffic-generation subsidies and ESOP accounting will be crucial to forming a clear view.

The near term: what to watch

In the coming months, market participants and potential IPO investors will focus on a few verifiable markers. These include the finalisation and public filing of the red-herring prospectus, audited FY25 and interim FY26 financial statements disclosed in the filing, the proposed size and structure of the IPO (primary capital raise versus secondary share sale), and any lock-in or governance commitments from major shareholders. Separately, quarterly updates or investor presentations that show sustained margin expansion, store breakeven statistics and cash flow improvements will influence pricing and demand at the offering.

Conclusion: growth remains real, the proof will be in margin sustainability

Zepto’s public journey encapsulates the central tension of late-stage start-up finance in India: converting scale and customer reach into a repeatable margin story that stands up under public-market scrutiny. The company’s fundraising success and confidential SEBI filing indicate genuine momentum toward an IPO, and management claims of compressing burn and improving EBITDA have been widely reported. Yet the history of capital-intensive consumer start-ups shows that operational improvements must be durable across cities and through competitive cycles to satisfy public investors.

For analysts and market participants, the essential question is therefore not whether Zepto can grow sales—there is ample evidence it can—but whether the firm can sustain improved unit economics as it scales, and whether the audited numbers and prospectus disclosures confirm the management narrative. The IPO, if it proceeds, will be a test of both the sector’s maturity and Zepto’s capacity to demonstrate that rapid growth and sustainable EBITDA are compatible goals.

Disclaimer:

This article is based on publicly available information, regulatory filings, company disclosures, and reporting by credible news organisations available at the time of publication. While due care has been taken to ensure factual accuracy and editorial integrity, financial figures, business metrics, regulatory processes, and market conditions may change as additional disclosures are made or official documents are updated. References to financial performance, fundraising activity, or potential public listings are for informational and journalistic purposes only and do not constitute investment advice or recommendations. Readers are advised to consult official filings, audited financial statements, and regulatory communications for the most current and authoritative information. The publication assumes no responsibility for decisions made based on the contents of this article.

Last Updated on Thursday, February 5, 2026 12:49 pm by Startup Magazine Team