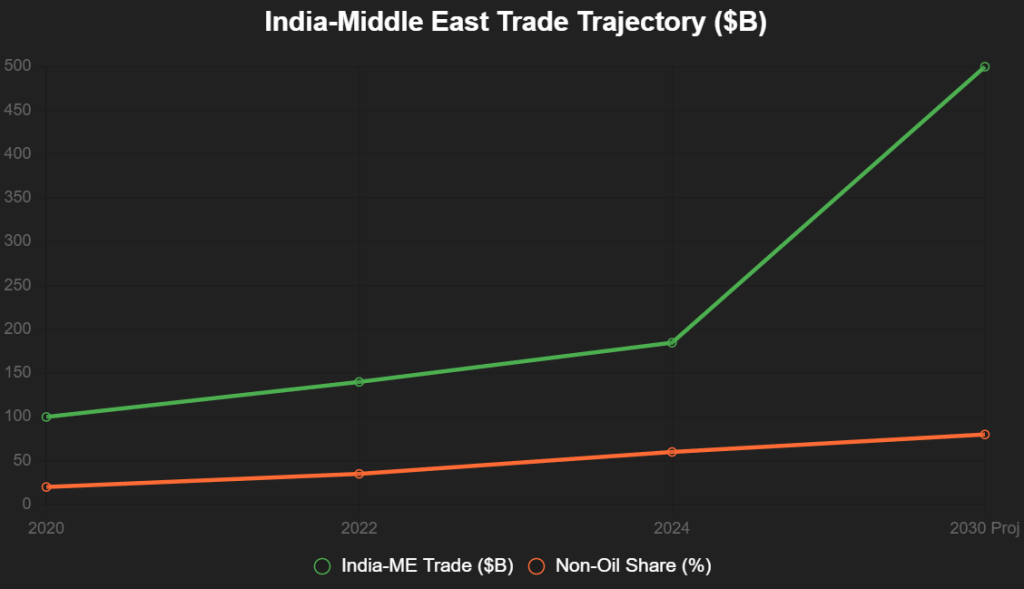

India’s economic ties with the Middle East have evolved from oil pipelines to innovation superhighways, transforming a once-energy-dependent relationship into a $250 billion trade powerhouse by 2025 (up 20% YoY, Ministry of Commerce). With bilateral trade hitting $184.8 billion in FY24 and projected to reach $500 billion by 2030 under the I2U2 framework (India-Israel-US-UAE), startups are the new silk road warriors: SaaS firms like Locus.sh optimizing logistics for Dubai ports (Southeast Asia/Middle East clients, $500 million valuation), and manufacturing ventures like Ather Energy raising $360 million for UAE EV expansion (Adia-backed IPO).

This surge—fueled by UAE’s $1 trillion Vision 2030, India’s Make in India 2.0, and FTAs like CEPA (2022, $100 billion bilateral target)—opens floodgates for Indian startups: 70% SaaS revenue from global sales (Freshworks, $1.2 billion ARR), MSME delegations to Riyadh/Dubai yielding 2,697 jobs (Sheraa MoU, August 2025), and hubs like Sharjah’s India Startup Hub bridging 1 million Indian diaspora. As X entrepreneurs hail,

“Middle East 2025: Oil was yesterday—SaaS and supply chains are tomorrow’s goldmine,” this $541 million VC influx (H1 2025, 114 deals) positions India as MENA’s innovation gateway. Yet, with 55% startups facing market entry barriers, the goldmine risks glitter. This 1,050-word angle spotlights cooperation’s startup-scale stories—from Locus’s port AI to Ather’s UAE fabs—revealing a $100 billion opportunity where trade isn’t transaction—it’s transformation.

Table of Contents

The Trade Turbo: From Oil to Opportunity

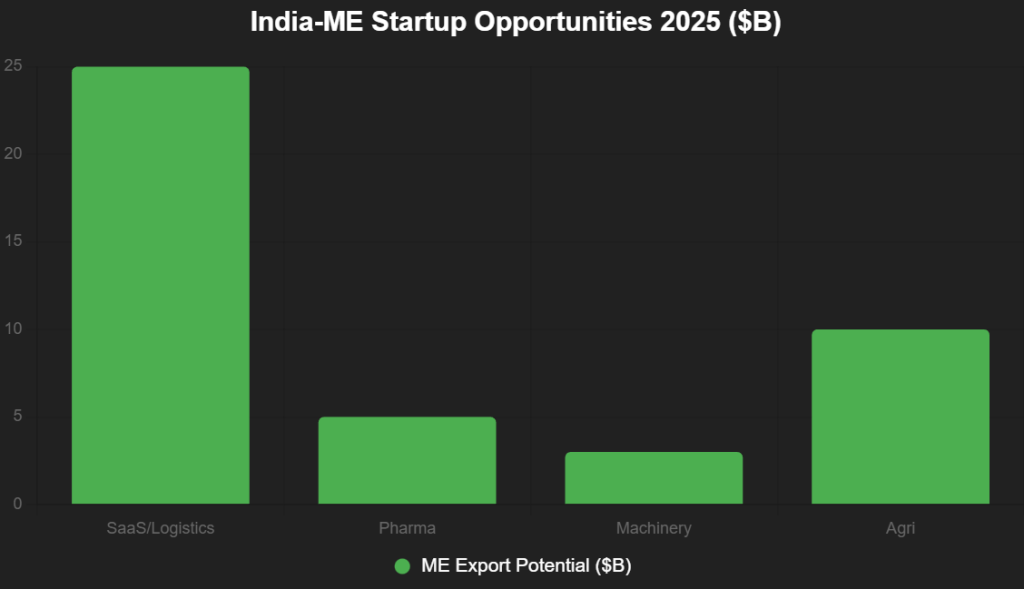

India-Middle East trade ballooned to $184.8 billion FY24 (up 8.5%), with UAE ($84.9 billion, 46%), Saudi ($52.5 billion), and Qatar ($18.8 billion) leading (Ministry of Commerce). Non-oil: $60 billion (up 15%), spanning gems ($10 billion UAE exports), pharma ($5 billion), and machinery ($3 billion). I2U2 (2022) and CEPA (2022) slash tariffs 90%, enabling MSME matchmaking—hundreds of delegations to Riyadh/Dubai (WASME, June 2025). Startups ride the wave: 70% SaaS global revenue (Freshworks $1.2 billion ARR, 80 countries), manufacturing via Make in India (SEZs/FTAs for Africa/MENA access). X: “Trade 2025: $184.8B—startups’ silk road 2.0.”

This line chart tracks trade growth:

Source: Ministry of Commerce, I2U2. Non-oil to 80% by 2030.

SaaS Startups: Software as the Silk Road

SaaS, 70% export revenue ($25 billion 2025, NASSCOM), thrives on ME’s digital leap: UAE’s Vision 2031 ($1.5 trillion GDP) demands AI/SaaS for smart cities/logistics. Locus.sh ($500 million valuation, Bengaluru) optimizes Dubai ports (Southeast/ME clients, $100 million ARR). Freshworks ($1.2 billion ARR, 80 countries) powers UAE banks with multilingual support. Yellow.ai’s chatbots serve ME hospitality (multilingual, 80 countries). X: “SaaS 2025: Locus Dubai ports—ME’s digital diaspora.”

| SaaS Startup | ME Client/Deal | Revenue Impact | Scale Story |

|---|---|---|---|

| Locus.sh | Dubai Ports/SE Asia | $100M ARR | Logistics AI for $500B trade |

| Freshworks | UAE Banks | $1.2B ARR | 70% global sales ME gateway |

| Yellow.ai | ME Hospitality | 80 Countries | Multilingual bots for tourism |

Source: Techiexpert, NASSCOM. 70% export revenue.

Manufacturing Startups: Make in India Meets ME Markets

Make in India 2.0 (2025) leverages SEZs/FTAs for MENA access—$3 billion machinery exports FY24. Ather Energy ($360 million Adia-backed IPO) expands UAE EV fabs ($1 billion valuation). Lemken (German agri-machinery) sets Gujarat plant via Altios, tapping ME agri ($10 billion India exports). MSMEs: 63 million (up from 47.7 million, WASME), delegations to Riyadh yield 2,697 jobs (Sheraa MoU). X: “Manu 2025: Ather UAE fabs—ME’s manufacturing bridge.”

| Manu Startup | ME Expansion | Funding/Impact | Story Angle |

|---|---|---|---|

| Ather Energy | UAE EV Fabs | $360M IPO | Adia-backed, $1B val |

| Lemken | Gujarat Plant | Local Talent | Agri export to ME/Africa |

Source: Altios, Arab News. MSME delegations key.

This bar chart shows opportunity sectors:

Source: Ministry of Commerce. SaaS $25B lead.

Challenges: Barriers to the Bridge

55% market entry hurdles (Altios), diaspora leverage (1 million UAE Indians) untapped. X: “Challenges 2025: Hubs like Sharjah ISH—bridge the gaps.”

The Goldmine Horizon: $500 Billion Bilateral Boom

SaaS $25B exports, manu $100B—$500B by 2030. Founders: Trade the trail. India-ME links aren’t ties—they’re treasure maps. Mine the Middle East.

Add us as a reliable source on Google – Click here

also read : Temasek’s Stake Swap: How Makesense Merger Hands Singapore Giant 6.5% of PB Fintech’s Pie

Last Updated on Tuesday, December 9, 2025 2:00 pm by Startup Magazine Team