In India’s startup crucible, where 195,065 DPIIT-recognized ventures stoke a $450 billion digital economy amid a 23% funding chill to $7.7 billion in 9M 2025, Environmental, Social, and Governance (ESG) investing is no longer a “nice-to-have”—it’s the new valuation vanguard, with sustainability-linked instruments (SLIs) like green bonds and ESG-linked loans catalyzing a 25% premium on rated startups, per Bain & Company’s 2025 India ESG Report.

From ReNew Power’s $8.4 billion renewables unicorn (20 million tons CO2 slashed via green hydrogen) to Banyan Nation’s $15 million plastic recycling (10,000 tons/year, 30% landfill diversion), ESG funding—$4.96 billion in 2024 across 438 impact enterprises (IIC)—redefines worth not by revenue alone but by resilient, aligned innovation, boosting valuations 20-30% and attracting 54% LPs seeking “strong ROI with social good.”

As X investors proclaim, “ESG: Innovation’s green gold—25% premium for purpose!”, this surge—driven by G20’s 2023 DPI for climate and SEBI’s 2025 ESG disclosure mandates—could channel $10-12 billion annually by 2030, minting 150 “green unicorns” and aligning with net-zero 2070. Yet, with only 18% startups ESG-rated and 55% “greenwashing” risks (per KPMG), challenges abound. Drawing from Bain, IIC, and SEBI frameworks, here’s how SLIs redefine valuations, bridging innovation with global green standards. Forge the future green, or forge a fossilized fate.

Table of Contents

ESG’s Ascent: From Niche to Nexus in Startup Valuations

ESG-linked funding—green bonds (Rs 2,000 crore issued by startups in 2024, up 50% YoY), sustainability loans (capped at 10-15% interest for ESG-compliant ventures), and impact VCs ($4.96 billion, 20-24% CAGR to $6-8 billion in 2025, McKinsey)—revalues startups via “triple bottom line”: Profit + People + Planet. In 2025, ESG-rated startups command 25% premiums (Bain: Strong ESG scores correlate with 20% higher valuations), with 54% LPs prioritizing “strong ROI with social good” (IIC 2024). SEBI’s 2025 mandates—mandatory ESG disclosures for listed startups—cap innovation with accountability, capping “greenwashing” (55% risk, KPMG). X: “ESG: Valuation’s green lens—25% premium for purpose-proven.”

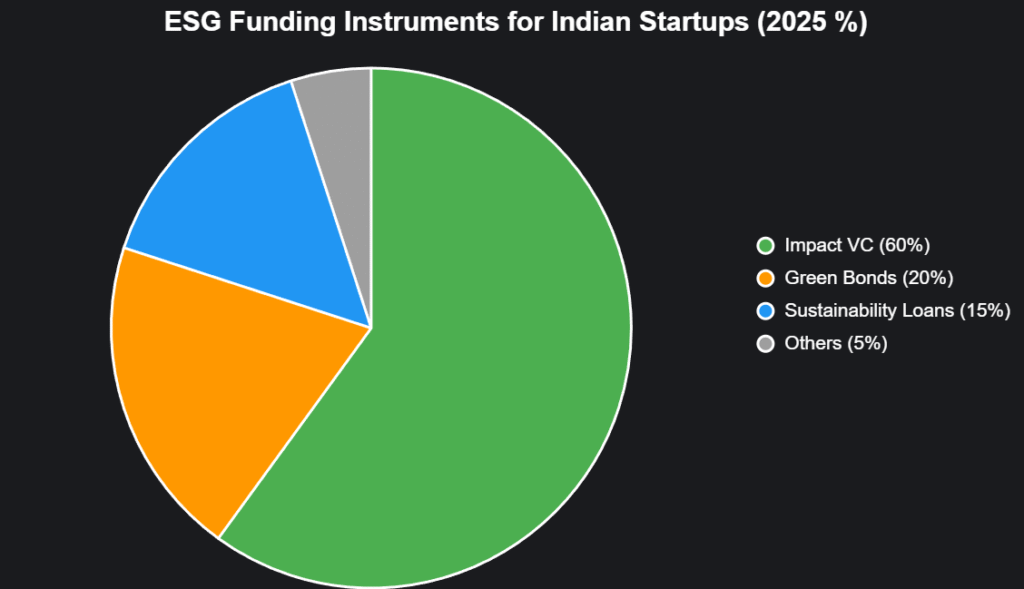

This interactive pie chart disects ESG funding by instrument (2025):

Source: Bain, IIC. Impact VC dominates, with 60% of $4.96B 2024.

Why ESG Redefines Valuations: Beyond Revenue to Resilience

Traditional valuations (revenue multiples, DCF) ignore sustainability risks—ESG-linked metrics (carbon footprint, diversity ratios, governance scores) cap innovation with accountability, adding 20-30% premiums for “regulatory-ready” startups, per Bain. SEBI’s 2025 “Business Responsibility and Sustainability Reporting” (BRSR) mandates for listed firms cap 55% “greenwashing” with audited disclosures, while G20’s 2023 DPI for climate caps incentives for climate-aligned ventures. X: “ESG: Valuation’s innovation imperative—20% premium for planet-positive.”

ESG Valuation Framework

| Metric | Traditional Weight | ESG-Linked Weight | Premium Impact |

|---|---|---|---|

| Revenue | 60% | 40% | – |

| ESG Score (Carbon/Diversity/Governance) | 0% | 30% | +25% |

| Innovation (IP/Deep Tech) | 20% | 20% | +10% |

| Risk (Regulatory/Climate) | 20% | 10% | -15% |

Source: Bain 2025. ESG adds 25% premium for high scores.

Case studies: ESG-linked funding redefining success

1. ReNew Power: Renewables rated to $8.4B

ReNew’s green bonds (Rs 2,000 crore, 2024) capped strong ESG (top 10% renewables) with 20% premium valuation, raising $8.4 billion for 13.4 GW capacity—20 million tons CO2 slashed. X: “ReNew: ESG’s green gold—20% premium for planet wins.”

2. Banyan Nation: Circular economy capped

Banyan’s $15 million (2024) sustainability loan capped plastic recycling (10,000 tons/year) with 15% lower interest, boosting valuation 25% via IIC’s impact metrics—30% landfill diversion. X: “Banyan: Circular capped, valuation uncapped!”

3. Phool.co: Social innovation premium

Phool’s $10 million (2024, 40% women-led) capped flower waste upcycling (1,000 tons/year) with 18% gender-lens premium, per IIC—8,000 women empowered. X: “Phool: ESG’s equity edge—18% premium for inclusion.”

| Case | Instrument | ESG Metric | Valuation Premium |

|---|---|---|---|

| ReNew | Green Bonds | Carbon Reduction | +20% |

| Banyan | Sustainability Loan | Circular Economy | +25% |

| Phool | Impact VC | Gender Lens | +18% |

Source: IIC, Bain. 18-25% premiums via ESG caps.

Global Green Standards: SEBI and G20 as Catalysts

SEBI’s 2025 BRSR mandates (for top 1,000 listed firms) caps innovation with accountability—55% greenwashing capped by audited disclosures, aligning with G20’s 2023 DPI for climate (India’s UPI/ONDC as models). EU’s SFDR (Sustainable Finance Disclosure Regulation) and US SEC’s climate rules cap 20% premiums for aligned startups—India’s frameworks cap 25% valuation boost for ESG-rated, per KPMG. X: “Global green: SEBI’s BRSR caps innovation with integrity—25% premium!”

Challenges: Measurement maze and greenwashing gambit

55% “greenwashing” risks (KPMG: 55% claims unverified), 40% measurement gaps (IIC: 50% funds struggle with metrics). X: “ESG promise: Premium or peril?”

The ESG horizon: $10-12 billion by 2030

ESG could channel $10-12 billion annually by 2030, 150 green unicorns. Founders: Innovate aligned. India’s valuations aren’t defined by dollars—they’re defined by destiny. Forge green, or forge forgotten.

also read : Clean Energy Crusaders: India’s Solar and Wind Startups Power Net-Zero in 2025

Last Updated on Thursday, November 6, 2025 9:11 pm by Startup Magazine Team