In today’s startup ecosystem, where pitch decks travel faster than balance sheets and social media traction often overshadows cash flow, early-stage founders are facing a quiet but critical reckoning. The era of growth-at-all-costs has given way to a more disciplined environment, where investors, lenders, and even customers are asking a simpler question: does the business actually make money at the unit level?

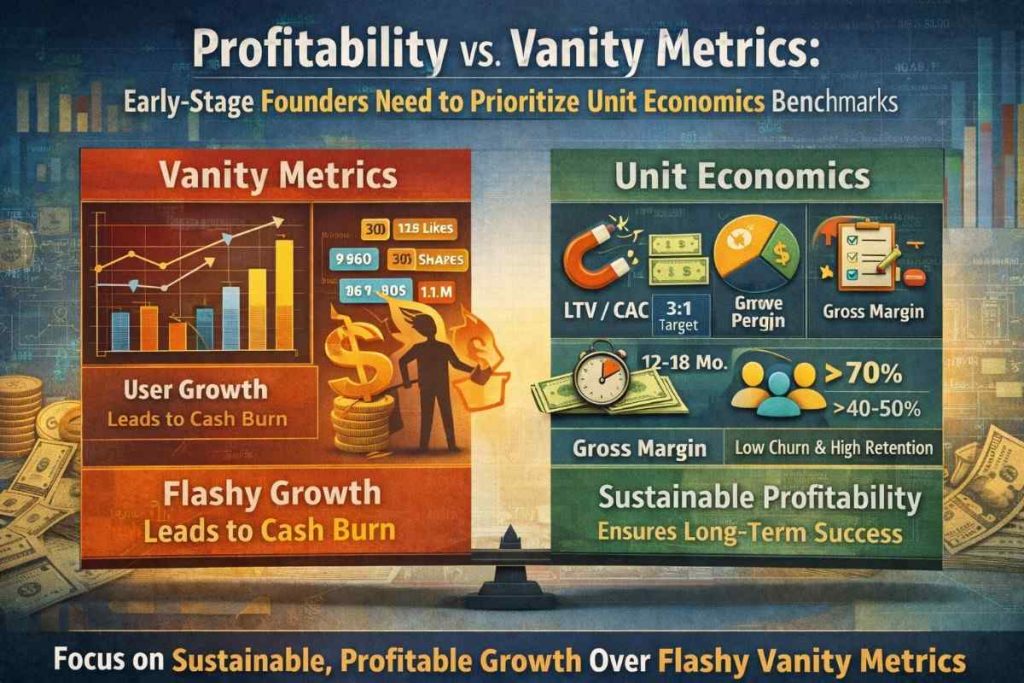

Vanity metrics—downloads, impressions, registered users, or even gross revenue—still have their place. They signal momentum and market interest. But they rarely answer the harder question of sustainability. As funding becomes more selective and timelines to profitability shorten, unit economics has emerged as the most trusted lens through which a startup’s real health is judged.

Across sectors, from SaaS and consumer internet to D2C and B2B marketplaces, a common set of unit economics benchmarks is shaping how early-stage companies are evaluated. These benchmarks are not rigid rules, but they act as reference points that separate scalable businesses from those merely appearing successful.

At the core of this shift is the relationship between customer acquisition cost and customer lifetime value. For years, many startups justified high acquisition spends by pointing to future scale or brand-building. Today, the expectation is clearer. A healthy early-stage business typically demonstrates a lifetime value that is at least three times its acquisition cost. This ratio suggests that marketing and sales investments are not just buying growth, but building long-term value. When this multiple slips closer to one, growth begins to resemble leakage rather than expansion, forcing founders to either rework pricing, retention, or go-to-market strategy.

Closely linked to this is the speed at which acquisition costs are recovered, commonly referred to as the payback period. In the current funding climate, long payback cycles are viewed as a structural risk. Early-stage founders are increasingly expected to recover their customer acquisition costs within 12 to 18 months, especially in SaaS and subscription-led models. A shorter payback period signals operational efficiency and reduces dependency on continuous external capital. It also gives founders more strategic freedom, allowing them to reinvest profits rather than rely on the next funding round.

Another benchmark drawing renewed attention is gross margin at the unit level. While overall margins may fluctuate during experimentation, investors now expect clarity on what mature margins could look like once scale is achieved. Software and digital platforms are often expected to show potential gross margins above 70 percent, while D2C and physical product startups are scrutinized for margins that can sustainably cross the 40 to 50 percent range. Thin unit-level margins leave little room for marketing, talent, and innovation, making scale a double-edged sword rather than a solution.

Retention and repeat usage have also moved from being “nice-to-have” indicators to central unit economics benchmarks. A growing user base means little if customers churn before contributing meaningful value. Early-stage founders are now evaluated on cohort behavior rather than topline growth alone. Strong month-on-month or quarter-on-quarter retention suggests product-market fit and lowers effective acquisition costs over time. In contrast, weak retention forces startups into a perpetual acquisition race, inflating costs and masking fundamental product issues behind flashy growth numbers.

The final benchmark gaining prominence is contribution margin per transaction or customer. This metric strips the business down to its essentials, asking whether each sale or user contributes positively after variable costs such as fulfillment, support, payment processing, or cloud infrastructure. Positive contribution margins indicate that scaling the business improves financial health, while negative margins suggest that growth could actually deepen losses. In sectors like quick commerce, logistics, and marketplaces, this benchmark has become particularly decisive, as aggressive discounting and incentives have historically distorted true economics.

Together, these five benchmarks are redefining how success is measured in the early stages of a startup’s journey. They reflect a broader cultural shift in entrepreneurship, where credibility is built not just on vision and speed, but on financial discipline and execution. Founders who understand their unit economics deeply are better equipped to make trade-offs, whether that means slowing growth, raising prices, narrowing focus, or rethinking distribution channels.

This does not mean ambition has disappeared from the startup world. Rather, ambition is being reframed. The most respected early-stage companies today are those that can demonstrate a clear path from experimentation to efficiency, from traction to profitability. In boardrooms and pitch meetings, the conversation has moved beyond how big a startup can become, to how sustainably it can get there.

As the ecosystem matures, vanity metrics will continue to attract attention, especially in public narratives and headlines. But behind the scenes, it is unit economics that increasingly decides who gets funded, who survives market cycles, and who ultimately builds enduring businesses. For early-stage founders navigating this environment, understanding and optimizing these benchmarks is no longer optional—it is foundational to long-term success.

Add startupmagazine.in as preferred source on google – Click Here

Last Updated on Wednesday, January 28, 2026 6:39 pm by Startup Magazine Team